New Venues, Evolving Room Rates and the Changing Landscape of Meetings and Events

Moving into the new year and leaving 2024 behind, many planners gaze into their metaphorical crystal balls, hoping for new trends to support their success.

Last year, Smart Meetings reported on limited new hotel supply and how factors like “bleisure” travel will increase room rates. This year, when we took the pulse of hospitality economic indicators by talking to experts, the bottom line was that the possibility of sourcing a new meeting space depends on where you look.

New Year, Fewer New Venues

Unfortunately for planners hoping to see a jump in new ballroom space offerings,

Unfortunately for planners hoping to see a jump in new ballroom space offerings,

Jan Freitag, national director of hospitality analytics at CoStar Group, didn’t have good news.

“So far this year, the room supply in the U.S. increased by 0.5%. A half-percentage-point increase, which is low,” Freitag said. The long-run average is 1.7%. “The pipeline hasn’t done anything for the last 38 months,” he observed.

Read More: New and Renovated: Most Anticipated of Openings of 2025

Freitag noted that the total number of hotel rooms under construction is between 150,000 and 160,000. He also pointed out that projects being opened are backfilled by other projects breaking ground. “We’re not seeing a rapid acceleration or deceleration in hotel rooms, and so we don’t expect that to change,” Freitag said.

What will change that straight line in the health of hospitality development? “The Federal Reserve may cut interest rates again; then maybe construction financing will be a bit easier. Eventually, we will see an uptick in the pipeline. But remember that those projects take two to three years to open.”

Supply Up in Some Cities

Don’t let that news bum you out, though. There’s a lot to look forward to this year. Freitag does see an increase in supply within the top 25 markets. Options are always appreciated by venue-seeking planners.

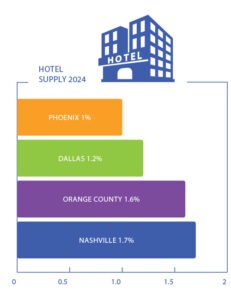

By the end of 2024, Orange County was up 1.6%, Nashville 1.7%, Dallas 1.2%, and Phoenix 1%.

“There are markets that are seeing new supply, but it isn’t a lot,” Freitag said. “The implications for meeting planners are that they have fewer new hotels to choose from.”

Hamish Reid, senior vice president of MICE at MMGY Hills Balfour, also pointed to localized trends that impact different sectors of the industry.

“The recent Marriott announcement of a softening in 2024 profits with weak U.S. domestic tourism demand being blamed may actually help event planners,” Reid said. “Rewind a few months, and a common complaint from them was a lack of hotel inventory for groups as hotels were buoyed post-pandemic.”

A weaker leisure could be good news for meeting planners.

“If leisure demand dips, we may see more competitive pricing in the sector, more flexible terms and conditions, and, perhaps most importantly, room stock availability that makes event planners happy,” Reid said.

Room Rates

The next big question: What’s the deal with room rates?

Freitag said CoStar is projecting that the RevPAR (revenue per available room) growth in 2025 will be 1.8%. “Hotels are getting more expensive but not as expensive as everything else. Room rates are growing but not as quickly as the CPI (Consumer Price Index), which we expect to be around 2%,” Freitag said.

The hospitality and executive search company LHC International pointed out in a “Changes in 2024” whitepaper published in July that inflation is softening, even if it is not reversing. Labor costs, which fueled much of the rise in 2023, have moderated and efficiency measures, such as self-check-in kiosks, mobile apps and automated housekeeping have helped to improve operating efficiency and guest experience. The result is that the sharp increase in Average Daily Rates (ADRs) seen over the past years has begun to level out. “This stabilization suggested that the industry has reached a ceiling for room rates, at least for the next season or two,” the report concluded.

Back to the Office … Maybe Not

There has been a lot of discourse around companies wanting workers back in the office.

In late 2024, Amazon released a memo informing workers they should expect to return to the office five days a week at the start of 2025. Is this an isolated event or an example of a broader trend?

Not so fast, Freitag said. “I think in Middle America, you have four days in the office, one from home. I don’t think we’ve seen a rapid acceleration or deceleration in returning to the office.”

The work-from home trend has led to more off-site meetings to bring remote workers together, but lack of traffic downtown has hurt occupancy in other ways.

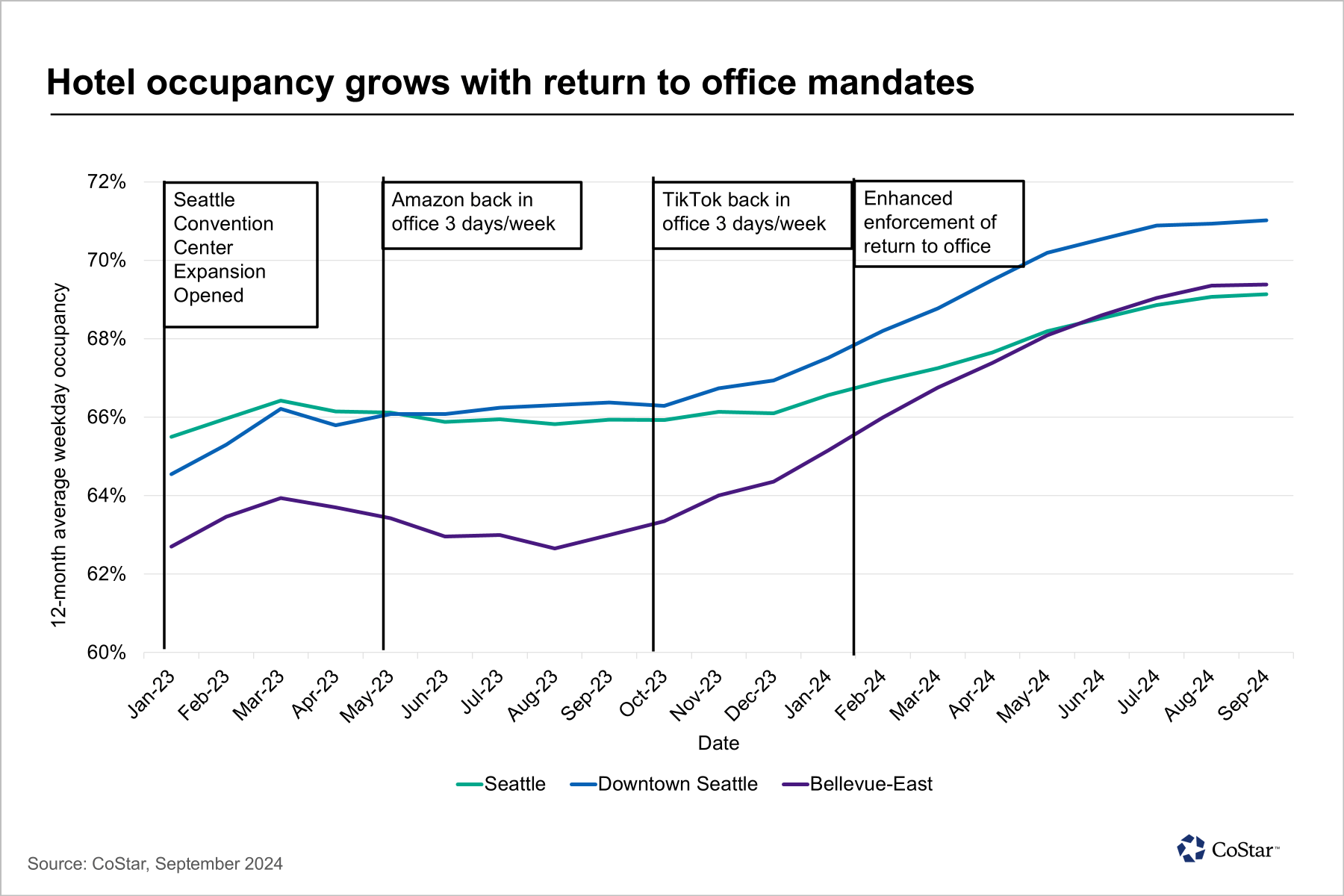

At an FICP event in November, Michael Dominguez showed hotel occupancy growing with the implementation of return-to-office mandates. The examples showed elevated hotel occupancy in the Seattle area with spikes in all three sectors in March 2023 once the Seattle Convention Center expansion opened and another spike in May 2024 with enhanced enforcement of return-to-office policies.

When face-time team meetings are required, they are often planned quickly and serve mainly to fill need dates. “The problem with those meetings is that they are booked with a short lead time. You used to have about six months or a year lead for a get-together. Now it’s in the quarter for the quarter, in the month. You all call the hotel and say, ‘I have 30 people during peak time, two nights. Let’s go,’” said Freitag.

The New Administration’s Impact

Freitag also pointed to the incoming White House administration as a pending factor influencing everything from deportations to restrictions on temporary visas.

“Who will pick the tomatoes, the strawberries and the avocados?” Freitag asked. “We see the implications in the farm and agricultural industries, and then what does that do to food cost?”

Read More: How Will Medical Meetings Be Affected by the New Trump Administration?

Changes in taxation, tariffs and Medicare/ Medicaid could result in more or fewer medical education, sponsorships, events and conferences.

As the year progresses, planners must wait to see the impact on event pricing. Pat Schaumann, CMP, CSEP, DMCP, HMCC, president of Schaumann Consulting Group and a director of MPI advised the meeting planner version of staying liquid. “As the global director of meetings, you might want to prepare for these potential shifts by focusing on flexible planning strategies, monitoring regulatory updates and staying aligned with corporate priorities. Engaging with key stakeholders to assess their perspectives on the political climate will also help in forecasting the potential impacts.”

Take the Dollar Overseas

Freitag said the U.S. dollar is strong overseas, which is good news for planners looking to host smaller group incentive travel, meaning a bigger bang for their buck.

“In 2023, everybody went to Athens. In 2024, many people went to Japan, Tokyo, and Kyoto because the dollar was so strong. That could be an implication for meeting planners who say, ‘I may just go to Berlin versus going once again to a top 25 market in the U.S.’”

Is the Content Good? Is the Event Sustainable?

You have confirmed the venue, the speakers, and the guests. But at the end of the day, the real question is: Is your content engaging?

“Business events are about business. If the business economy stagnates, we may see a short-term impact,” Reid said. “But recent economic slowdowns have shown that companies understand the value of their business events in engaging customers at third-party trade shows and their own events, as well as engaging and rewarding their own employees, so any impact will be minimal.”

Reid said this ultimately impacts the attendees’ engagement and the event’s overall structure.

Read More: Sustainable Event Planning: Action Steps to Lasting Strategy

“A buffet and limitless coffee are no longer enough to attract delegates to attend. It’s about the content and the ability to meet customers to demonstrate ROI,” Reid said. “Events need to yield data and results, and content needs to be fresh, current and interactive.”

Snagging the attention of attendees and turning them into repeat guests is crucial for planners hosting annual events, regardless of the economy.

“Business events are about business. If the business economy stagnates, we may see a short-term impact,” Reid said.

Reid also noted that sustainability is a significant factor planners should consider.

“Sustainability continues to play an important part in our lives, so it will continue to grow in importance for event planners to ensure they are delivering events in an eco- and socially responsible manner,” Reid said.

Tradeshow Insights

For tradeshow organizers, Reid noted a few trends.

“There seems to be a growing threat again of guerrilla marketing activities, with industry practitioners not investing in the trade show itself but directly engaging with the community that the show creates,” Reid said. “This isn’t anything new, and COMDEX and its decline from 200,000 visitors is a well-known case study triggered by leading computer manufacturers engaging directly with the attendees.”

Reid also said that people’s lifestyles have evolved, leading to a lot of crunch-time planning. “This will impact B2B event organizers with more last-minute registration, making their events a nervous roller coaster of viability,” Reid said.

Events are also becoming more immersive and experiential. Reid pointed to technology as a key resource in that progress. “Technology will quicken real-time inclusion and facilitate nontraditional venues in different ways,” Reid said.

This may include venues that are readily accessible for all guests and multi-language real-time closed captioning. At the same time, generative AI is elevating expectations of how quickly content can be personalized and distributed.

2025 Travel Forecast

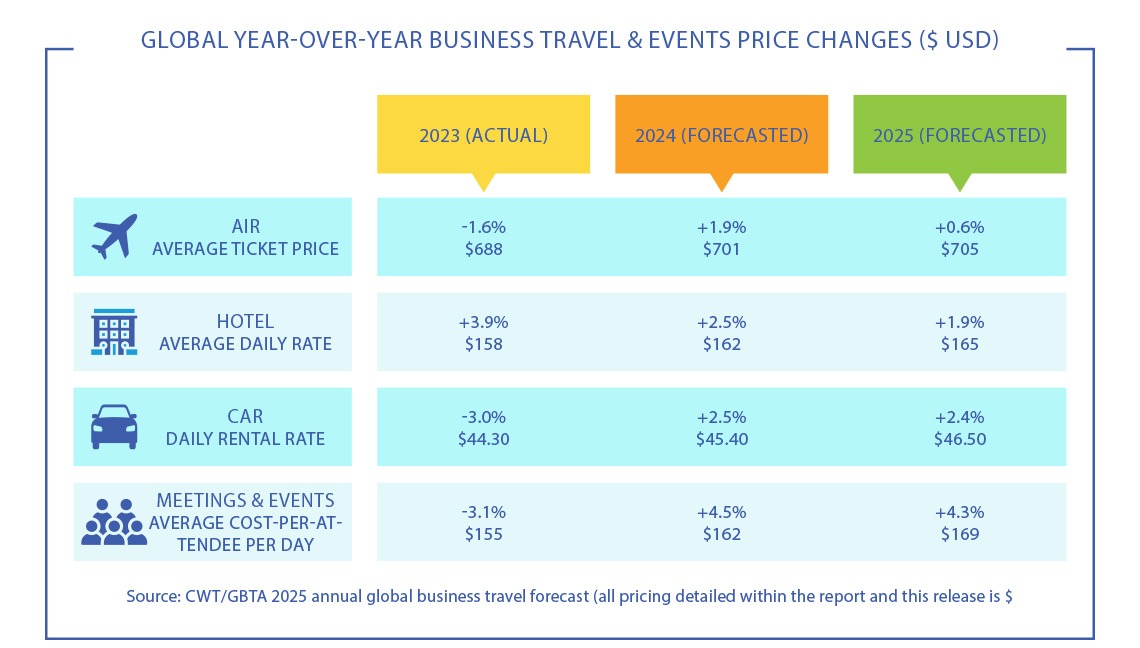

More food for thought for planners in the new year, according to the CWT/GBTA 2025 Global Business Travel Forecast. Consider the aggregate costs.

The global year-over-year business travel and events forecast projects the average ticket price will likely increase by 0.6% ($705), the average daily hotel rate will likely go up 1.9% ($165), the daily car rental rate is forecast to go up 2.4% ($46.50).

Taken all together, the average cost-per-attendee per-day for events and meetings is likely to increase by 4.3% ($169). When the average rate of inflation measured by the CPI is 2.6%, meeting professionals are going to be in the uncomfortable position of explaining the supply-and-demand, trickle down price increases and bottom-line costs to attendees facing higher-than-expected ticket prices.

Hopefully, this article will help.

Smarter, Faster, Easier

What instant booking tells us about the meetings industry

What instant booking tells us about the meetings industry

What are the current booking trends that planners need to be aware of in the new year? Smart Meetings caught up with Kristi White, vice president of reporting, data and analytics at the instant booking company Groups 360, for a look behind the sourcing curtain into who is booking what. Data from the company’s GroupSync platform shows more corporate activity, and most instant booking completed within 3 months of the meeting date.

Smart Meetings How does online booking impact how meeting professionals plan?

Kristi White The advent of (and a trend toward) instant booking for groups is a game-changer for meeting professionals, especially for smaller meetings with shorter time windows for planning. It saves a tremendous amount of time for the planner since they can see and compare published group rates and availability in real-time—not just for sleeping rooms, but also meeting spaces and services like catering and AV at multiple properties all at one time in one place without spending time researching information, sending multiple RFPs and waiting for responses. This also saves time for hotel sales teams and makes them more efficient and profitable since it frees them up to focus on larger or more complex events that may require an RFP.

SM Where is the group segment of the instant booking market going in the next 1-3 years?

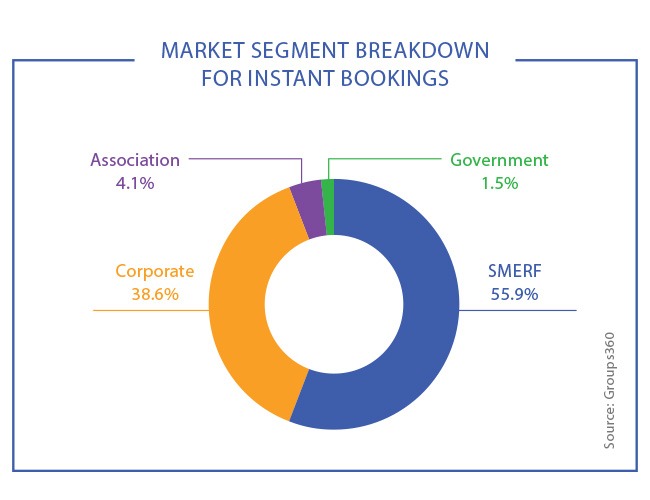

KW In the hotel market, group booking has traditionally been dominated by SMERF (social, military, educational, religious and fraternal) groups, but we have seen a stark rise in corporate meetings following the pandemic, as much as 38% of instant bookings. We believe that the trajectory will continue over the coming years.

With remote workforce structures now becoming the norm, enterprise companies are booking smaller, more frequent on-site meetings to build momentum, connection and collaboration among their distributed teams. They are preferring off-site meetings at various locations—not just bringing everyone to the home office. This keeps them engaged, excited and focused.

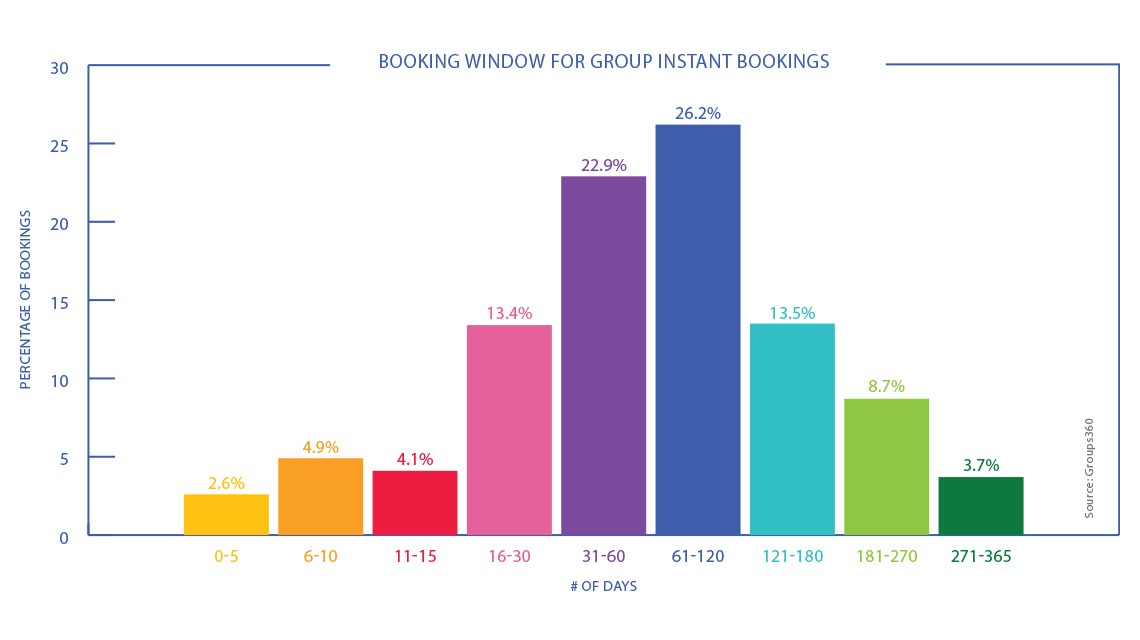

The majority of instant bookings are small in room block and lead time. 62% occur 16-120 days from arrival and 82% cover fewer than 40 total room nights with the average rooms on peak at 14. Most are booked during weekdays with Tuesday as the most popular, but more than half (53%) occur outside of regular business hours before 8 a.m. or after 6 p.m.

When it comes to geographic location, 53 countries and 600 markets around the world received instant bookings. The top five countries are the United States, the United Kingdom, Canada, Germany, and Mexico.

The top 10 markets are Atlanta; Washington, D.C.; Chicago; Dallas; Phoenix; Oakland, California; Denver; London; Los Angeles and Nashville, Tennessee.

This article appears in the January 2025 issue. You can subscribe to the magazine here.