The forecast for incentive travel over the next two years is mostly sunny with a chance of tighter budgets and an abundance of hand sanitizer. 2020 Incentive Travel Industry Index survey of 2,300 people, conducted by Oxford Economics in partnership with Incentive Research Foundation (IRF), Society for Incentive Travel Excellence (SITE) and Financial & Insurance Conference Professionals (FICP), found that two-thirds of incentive travel buyers and suppliers expect incentive travel to recover within one to two years, once post-COVID conditions have been reached.

More: What Does a COVID Vaccine Really Mean for Travel and Meetings?

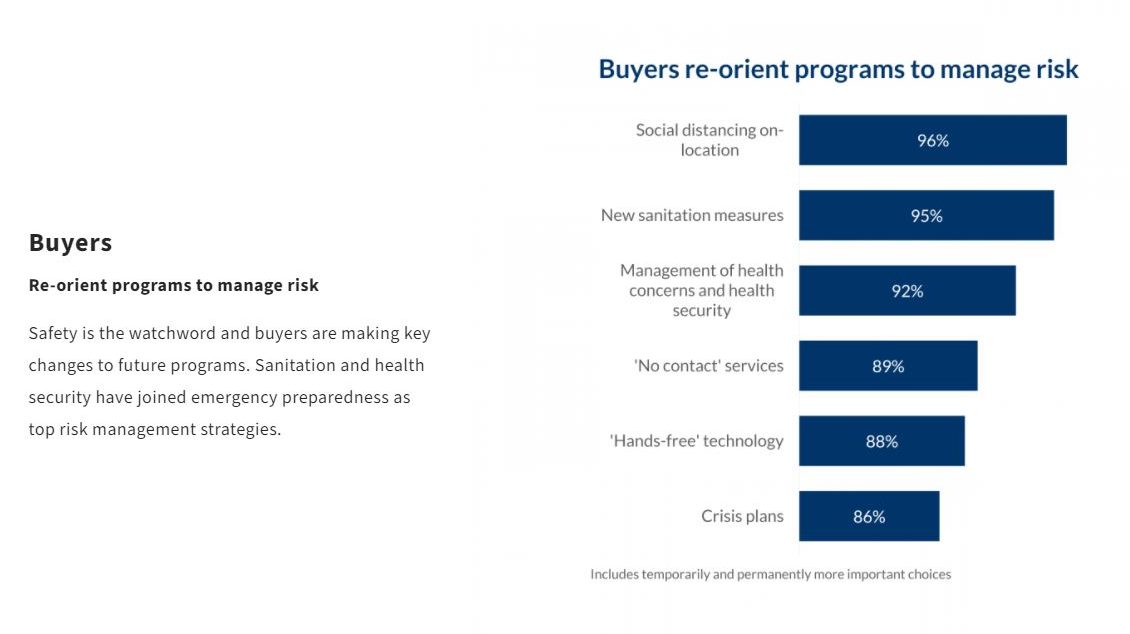

“Sanitation and health security will be permanently more important risk management strategies,” said FICP Executive Director Steve Bova, CAE. “Within the financial and insurance industry, we see greater optimism about recovery and stronger desire to travel, but this is counter-balanced by greater reluctance among qualifiers to travel and higher company risk aversion.”

In addition to new risk management strategies, future destination selections and program characteristics and activities are also anticipated to shift as a result of the pandemic.

“In the short to mid-term, domestic and close-by destinations will replace trans-continental and international destinations. However, there’s also a decisive shift away from buzzy urban locations to quiet countryside retreats and a definite preference for the road less travelled,” said SITE Chief Marketing Officer Padraic Gilligan.

IRF President Stephanie Harris shared the results in an exclusive Smart Meetings Accelerator webinar today and was optimistic about how meeting professionals have innovated during the disruption and what that means for a segment of the events industry that is difficult to replace with a Zoom call. She cited pent-up demand as an indicator. “The desire to travel is the greatest positive factor expected to influence the recovery, with 64 percent citing greater appreciation for travel after being restricted from doing so.”

Also a positive sign: Most senior-management stakeholders (83 percent) who sponsor incentive travel remain committed to incentive travel, although many buyers expect incentive travel will need to fundamentally change to reduce risks. Travel incentive pioneers have already been moving forward with programs, experimenting with new features and learning how to deliver luxury experiences that follow safety protocols.

For additional key findings from the 2020 ITII survey or previous-year data, visit here.

Soft Power, Security Rising

Benefits such as improved engagement, enhanced customer satisfaction and better relationship-building both between employees and management and among fellow employees—items often categorized as soft power—were seen as the greatest benefits of incentive travel.

“This marks a shift from 2019, when company sales and profits were top-ranked benefits,” Harris said. A renewed focus on experiences that will delight the individual traveler, with fewer corporate obligations such as group dining and team building, was seen as more popular in post-COVID incentive program activities.

Unsurprisingly safety, security, the health and well-being of attendees jumped up in importance. That mandate included giving people a sense of comfort, that it is safe to travel again. The survey showed that meeting professionals are doing that by opting for smaller, less crowded destinations, places that were perceived as doing a good job of managing pandemic numbers and outdoor locations. “These could be short-term shifts, but they are definitely a departure from previous years,” Harris said.

Budget Constraints

While meeting professionals on both sides of the contract were optimistic about incentive travel returning even faster than the rest of the industry, the return to activity was seen as more robust than the full budget return. “We are going to be facing some continued budget pressures,” Harris said. “We’re still in this to do more with less kind of culture.”

The silver lining, she predicted is that people will be so happy to be out and traveling again that they will not be expecting some of the extravagant expenses that may have been possible in the past. The shift to more local, less urban destinations and more “pure travel” freedom away from scheduled activities could help as well.

Respondents noted that they would be relying on DMCs—and CVBs for that matter—to help with logistics as they manage restrictions in specific locations and solutions for adding local culture without breaking the budget.