The Global Business Travel Association (GBTA) just released their fourth quarter report for economic trends and business spending in 2015, and the results are hinting at a stable 2016, despite the current status of most countries to date.

The report, produced in partnership with Carlson Wagonlit Travel (CWT), found that the U.S. economy has returned to pre-Great Recession footing and, as a result, U.S. business travel can expect to see a 3.2 percent growth from last year, and an additional 3.5 percent growth in 2017.

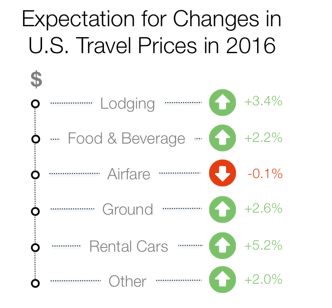

This growth, however, is largely due to price increases of lodging, food and beverage, ground transportation, rental cars, and more. In fact, the only factor the GBTA doesn’t predict will experience a price increase is airfare.

Despite historically low levels of business travel inflation in 2015, BGTA predicts 2016 and 2017 will see price growth return to normal rates (2.6 percent and 3 percent growth, respectively).

Why is the U.S. alone when it comes to a stable travel market? Asia-Pacific, Latin America, the Middle East and Africa—which were a drag on the global market last year—will likely have a similar year for 2016.

In a survey conducted by GBTA, 44 percent of travel managers in Asia Pacific indicated that increased airline fees will contribute to increased travel spend in 2016. 38 percent of those in Latin America agreed with this sentiment, as well as 44 percent of those in North America.

The report predicts that all regions will see a price jump for hotels—from 0.7 percent in Western Europe, all the way up to 3.7 percent in Latin America and the Caribbean.

(Photo courtesy GBTA)

Tips for Successful Business Travel

In response to the volatile global market, the GBTA compiled a quick list of tips for success in the year ahead for travelers:

1. Use predictive analytics to compile a complete set of data to make the best budget and travel decisions for you and/or your company.

2. In 2016, it will be crucial to perform at or above expectations if you want to benefit from any negotiating clout with current suppliers, which means you must have a firm grasp on your company’s performance.

3. Remain open to new models such as dynamic hotel pricing, single sourcing for airlines, low-cost carriers, and sharing economy providers.

4. Fully understand your (and your company’s) travel behavior. Use targeted communication such as individual scorecards, online training or gamification to help control traveler behavior and cost.

5. Utilize technology to your advantage in order to compare rates, and take advantage of last-minute booking deals.